Aaj Digital... Toh Kal Befikar...

Securely manage your insurance policies anytime, anywhere! ✨ eIA Account Creation is Completely FREE - No Hidden Charges ✨

Securely manage your insurance policies anytime, anywhere! ✨ eIA Account Creation is Completely FREE - No Hidden Charges ✨

Transforming insurance with innovative, digital-first solutions for a hassle-free experience.

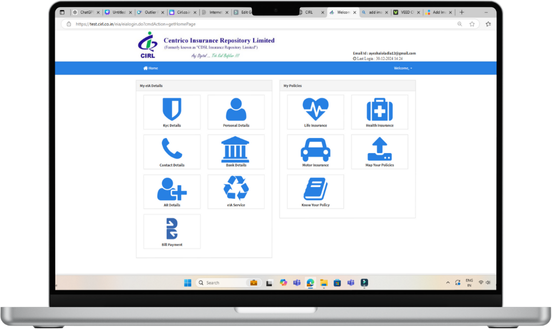

Centrico Insurance Repository Limited (CIRL) is dedicated to empowering individuals with a secure, paperless, and seamless insurance management platform. From digital policy storage to streamlined claims and grievance resolution, we provide a transparent and efficient way to handle all your insurance needs.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Sign up using your mobile number or email. It's completely free!

Verify your identity by submitting any approved documents.

Get your eIA account number instantly after verification.

Link your insurance policies to your eIA account for easy access.

Access KYP (Know Your Policy), grievance resolution, and more.

Learn how to easily set up your Digilocker account in under 2 minutes.

Follow step-by-step to open your electronic insurance account.

Understand how to view, manage, and pay your premiums with ease.